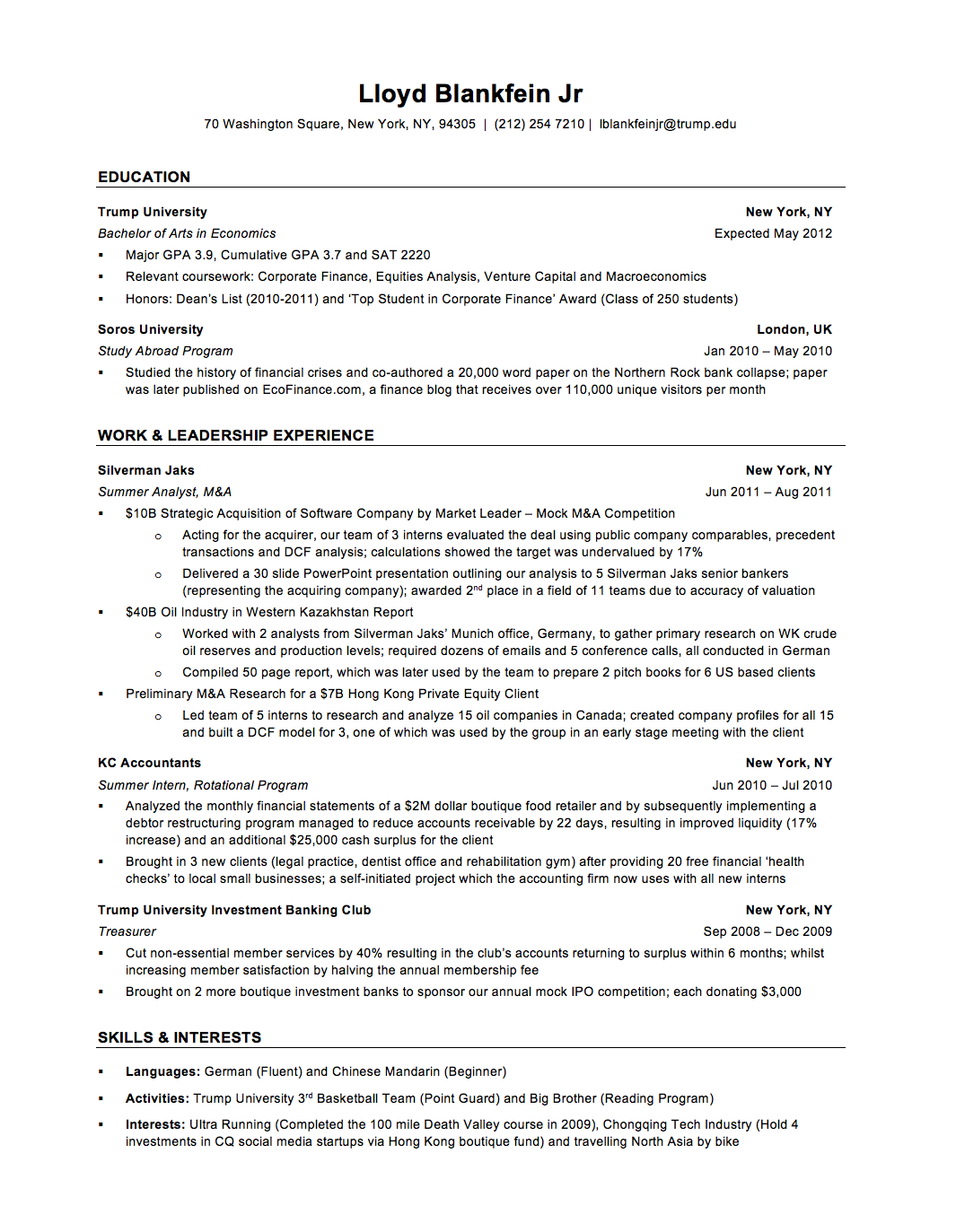

So you want to write an A-grade investment banking resume? Let’s first of all take a look at an A-grade resume sample.

There are many resume samples, templates out there, but you ought to know which are the ones which worth your time to look at. Now here’s one I like to share with you. It is in fact the one that I presented in the last post which has a perfect layout. And now I’m going to analyze its content.

Here’s how an A-grade banking resume looks like…

Let me check first of all check this resume against the 10 basic rules of an investment banking resume.

- Layout – 1 page with a clear layout. Has only 3 sections – education, work and skills. These are all that is needed.

- Reviewed by insiders. This is from the Inside Investment Banking (IIB) website, of course, it has been reviewed by insiders. In real life, if your insider friends or acquaintances are too busy to help, may consider a paid service. IIB provides all-round Inside Investment Banking career assistance to students.

- Flawless. I can’t find any mistakes, errors. Can you? To find bones in eggs, I may add couple of hyphens like 30-slide PowerPoint and 50-page report.

- School brand, GPA score, work experience. Interest and hobby. You can find all these. Simple, concise and easy to read.

- Work section focusing on achievements. The achievements are phenomenal, the presentation is beautiful and the writing is articulate (and succinct!!). But what if you don’t have similarly prestigious investment banking work experience or achievements? No problem. To win bankers hearts and minds, get an insider investment banking resume writer to help. After all, they’ll be able to help students turn a mediocre track record into something that looks amazing on their resume.

- Be conservative. This is a classic example of how banking conservation is in presentation. Clean layout with good balance of white space. This is exactly what bankers like to see, and read, of course.

- List your SAT scores. GPA and SAT scores could be found at the top of the resume. Great strategy for a student’s resume.

- No lies or exaggerations. I can’t tell at this stage. But if there is any, you’re simply wasting your time, effort and even money in writing it.

- Powerful words. Can be found all over the place, evaluated, compiled, created, analyzed, improved liquidity…

- Banker friendly terms. M&A, DCF, IPO…

Further Evaluation

ON DESIGN

Notice the white space, line spacing and lack of clutter in this sample banking resume? But at the same time you’ll find enough information packed into this resume.

This is what investment bankers love.

In the first glance (~5 seconds) readers can find school, scores, work experience and something about your personality – simple! Your banking resume will stand out from the crowd because of this.

Other notes on readability…

Notice that only a handful of items are bold. That’s it.

It is very easy for a banker to scan the document to find the experiences they want to read about.

How to fit everything on one page

You’ll find some tiny little things here, but they all work together to contribute to your one-page investment banking resume.

- Name and contact details go on two lines only. Multiple interests or activities on one line, separated only by commas.

- Crunch the 2 summary lines into 1, so for example you would then have “Trump University, Bachelor of Arts in Economics – New York, NY” all on one line.

- Take line spacing from 1.1 to 1.0.

- Reduce page margins. But don’t go below 0.75 inches on each side.

- Take the body font down by about 0.5.

- Reduce the paragraph spacing between dot points.

- And if you still need help consider switching fonts. Compare Verdana 10 with Calibri 11. Calibri is a simple and easy to read font, elegant and at the same time occupies far less space than many other fonts.

- Eliminating mediocre achievements and superfluous words in your descriptions.

- If you’ve tried everything but still need a little more space. Then consider this – Omit “Proficient in Excel, knowledgeable about valuation concepts, expert in PowerPoint”. These are job requirements. And the recruiters assume you possess those – otherwise you shouldn’t apply. True, as a professional IB recruiter, I never put this on candidates’ CVs.

Choice of fonts between Serif and Sans Serif ?

IIB suggests serif fonts. I personally prefer sans serif. Either way, investment banking resumes should go for easy-to-read fonts. Remember the banking conservativeness? For serif fonts, Times New Roman and Garamond both look classy and clear. For sans serif, Arial and Calibri both look good and space effective.

Some rule of thumb about font sizes.

16 – Your name (Bold)

11 – Headings (Bold and CAPITALS allowed)

10 – Body text – depending on the type of font you use, keep ceiling 11, floor 9.5

In the sample resume above, there are only 3 Headings applying both bold and capitals to draw attention. School and company name using upper/lower case and bold. Degrees and positions in regular italic. Simple. Banking conservativeness applied.

ON EDUCATION

For a junior banker’s resume, Education should appear at the top. See how simple this section is in the sample resume. There’s no need to go on and on here. Bankers after all only care about your school name, GPA score and studies. Why clutter this space with other things?

To save words and align with the one-page strategy, there’s no freaking need to put “/4.0” next to your GPA. Bankers know it’s out of 4.0! This is a small example, but this indicates how you consider the reader when constructing your IB resume.

ON WORK AND LEADERSHIP

Combined work and leadership

This is because leadership roles are work. And often for students, their leadership experience will be as impressive, if not more, than their actual work experience. This will help keeping your resume at as simple as 3 sections. Bankers won’t expect a student to lead a big team to do big projects. But at lease write something that shows your ability to influence others.

Only 3 experiences have been included

And they are naturally the 3 most impressive work experiences!

Results are all we talk about

Bankers know what an intern has to do, so they are not interested in “Responsible for organizing meetings with staff, answering client query calls and taking minutes at meetings”. Instead they like to see e.g. “Analyzed the inventory wastage rates for 30 days and found a way to reduce wastage by 35% via implementing an automated ordering system, which resulted in $2,000 food savings every month and increased front/back-of-house harmony”.

See how and why the above A-grade resume stand out? There are results that make the bankers’ eyes blink.

Simplicity wins

Notice there isn’t 10 dot points per job covering fairly average results/achievements or mere tasks? Instead, there are only 2-4 MEGA achievements/results for each job.

Knowing which dot points to put down is easy to achieve when you focus on the results you achieved from your 2-3 biggest projects at that job.

ON SKILLS AND INTERESTS

How to make this section pop?

This section is to bring out your personality, something that will make you more than just another piece of paper, something that will make you memorable!

Personality helps you stand out from the crowd. And the interest/hobby section does this job.

There are 3 sub-headings – languages, activities and interests. In fact you can add ‘others’ to the end. People start by reading from top down. Before they finish, what’s written at the very bottom may also get a glance. That’s why back cover advertising is always as expensive as those at the front page of a magazine. Let’s talk about what to include in this ‘other’ part later on.

Language – English is not listed, because it’s obvious, so as Excel, Bloomberg etc. Imagine if you don’t speak or write English, cannot use Excel or don’t know what Bloomberg is, then investment banking is not a place for you.

Activities – Include only your most important/passionate skills, activities and interests. Go ahead beat the competition by displaying your personality in this section. After all investment banking is a people business, bankers are stressful at work, so they would like to meet and work with interesting people who does interesting things at their spare times.

In the sample resume above, the “Death Valley” was a good pick; that’s going to pop out, and get bankers excited. When it comes to interview time, this section is literally going to drive 20% of the interview questions you get! You see bankers will be desperate to talk to you about your investments in Chongqing, your Death Valley running and more.

ABOUT THE ‘OTHER’ SECTION

List anything else that will make your personality shine. Scholarship is one of the most attractive factors on intern/student resumes. When I did banking resume critiques for students, there was one who made me remember him all the time. He wrote about an MNC SCHOLARSHIP that he won over a four-year period totaling $500,000. My market resources indicate that MNC scholarship does exist but the amount the candidate received was rarely given, except to really outstanding students.

You may not have received such scholarship. Do you have anything that really distinguishes yourself from others? Write it in an ‘other’ section at the end and the sleeping banker will be wakened by you and may call you up for an interview immediately.

NEED MORE HELP FOR YOUR INVESTMENT BANKING RESUME ?

If you want to see more investment banking resume samples (and even A grade cover letter samples), plus learn how to turn a track record of mediocre achievements into a rocking banking resume, then check out the Inside Investment Banking website. They have a lot of freebies to help you find your way to investment banking. They also have paid services but you don’t have to buy anything if you don’t want to.